Federal Tax Updates 2025

Federal Tax Updates 2025. While 2025 did not see major. Effective jan 1 2025, irs has updated the federal tax brackets.

On april 16, 2025, the federal government presented its 2025 budget “fairness for every generation” in the house of commons. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax rate schedules and other tax changes.

Tax rates for the 2025 year of assessment Just One Lap, Washington — the irs encourages tax professionals to register now for the 2025 irs nationwide tax forum, coming this summer to chicago, orlando,. One highlight of the mop.

2025 Federal Tax Brackets And Rates Rasla Cathleen, 2025 federal income tax brackets and rates. Keep your federal tax planning strategy on track with key irs filing dates.

2025 Easy Federal Tax Update • 8 Hrs CPE Credit, 10%, 12%, 22%, 24%, 32%, 35% and 37%. On april 16, 2025, the federal government presented its 2025 budget “fairness for every generation” in the house of commons.

Irs Tax Filing 2025 Sadie Collette, Effective jan 1 2025, irs has updated the federal tax brackets. Our 2025 tax calendar gives you a.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, India’s direct tax collections surge 17.7% in fy24 to ₹19.58 tn. The 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

Federal Tax Brackets 2025 Single Mela Stormi, One highlight of the mop. Our 2025 tax calendar gives you a.

What the New Federal Tax Brackets and Standard Deductions Mean for You, 2025 federal income tax brackets and rates. The income tax brackets for individuals are much wider for 2025 because of inflation during the 2025 fiscal year.

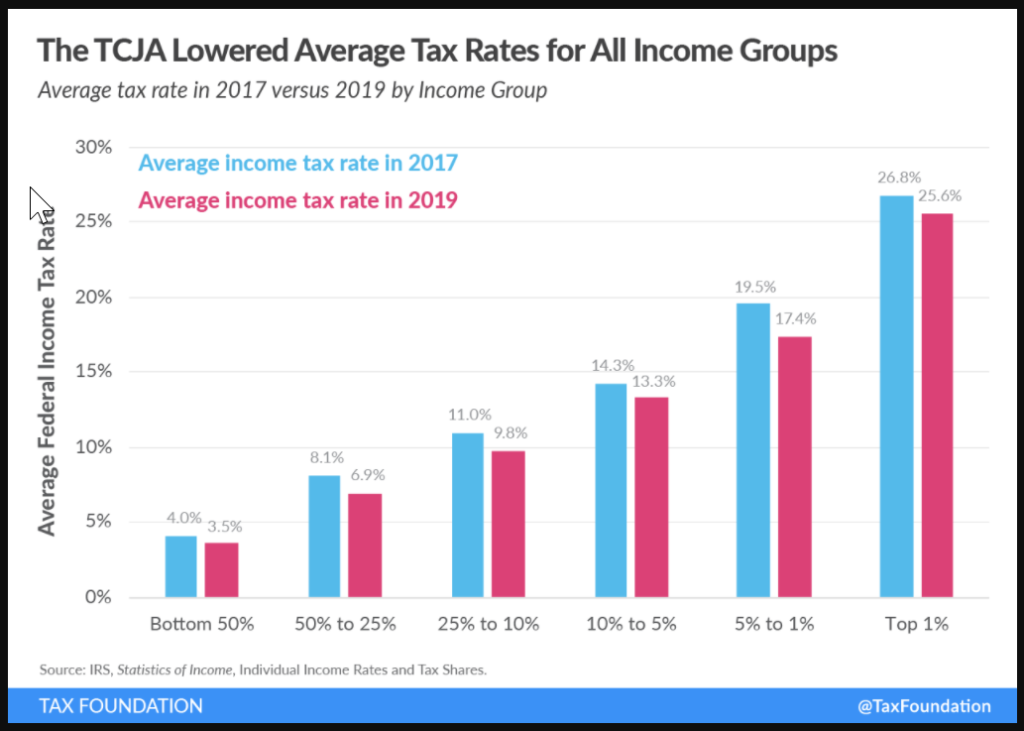

The 20232024 Federal Budget Updates Key Tax Measures, Washington — the irs encourages tax professionals to register now for the 2025 irs nationwide tax forum, coming this summer to chicago, orlando,. 2025 is in full swing on capitol hill with the introduction of a new $70 billion tax package to revive child tax credits, the tax cuts and jobs act (tcja), and more.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 10%, 12%, 22%, 24%, 32%, 35% and 37%. The irs has announced that there will be a 5.4% bump in income thresholds to reach each new tax bracket.

Summary of the Latest Federal Tax Data, 2025 Update Actuarial News, There income brackets for marginal tax rates were. 10%, 12%, 22%, 24%, 32%, 35% and 37%.